This is Chapter/Lesson 4 covering Real Estate. If your initial reaction is to skip this chapter, please don't -- real estate can work well for those looking for income and those looking for growth comparable or superior to that of stocks, plus it adds diversification to your investments. To whet your appetite further, here are excerpts from a recent article: "Rental properties offer tremendous stability. Studies...show that investments in the single-family rentals market offer similar returns to the stock market, but with less volatility." "Returns on single-family rentals are uncorrelated to the stock market...[which]...makes single-family rentals an excellent choice for anyone who wants to diversify their portfolio and hedge against market downturns."

And the claim that in addition to less volatility it can deliver returns superior to that of stocks is a fact, proven by a branch of the Federal Reserve in the most comprehensive analysis of investment returns ever conducted, as you can read here.

The first real-estate approach we'll focus on here is that of buying a condo or duplex and renting it out. It does require more funds, but it has clear advantages (we even cover one for truly aggressive investors that can yield returns of nearly 100%, 10 times more than the return of stocks). Other real-estate investment approaches that require only hundreds of dollars of investment -- not hundreds of thousand of dollars -- are covered later, and you can jump right to them by clicking here.

Like all the chapters, this is easy reading, intended for someone who has had little if any investment experience, and only takes a few minutes. When you've read the 5 chapters, you'll be ready to invest. If you're in a hurry, this page is summarized in the box on the right. If you're too busy now to go through these Chapters, read this 3-minute Summary. To start at the beginning, please go here. A glossary of investment terms is here.

You might think that our focus is too much trouble, but it can be virtually hassle free. And it can deliver superior results. Structured for income, it can be more rewarding than bonds plus, unlike bonds, the investment can also grow in value as the real estate appreciates. And if it's tructured for growth, it can perform better than stocks -- in one instance 10 times better than stocks -- with significantly less volatility.

While this investment can be virtually hassle free (more on that here), one drawback is liquidity. Unlike stocks and bonds, where you can sell and get your money out in a day, it takes several months to sell your property if you suddenly need money. But, like stocks, your purchase of a property to rent out should be a long-term investment.

There are TWO APPROACHES covered in the next 2 sections: the first one is where you buy all-cash to generate income, and the second one is where you buy with a mortgage for growth.

APPROACH 1. Real Estate Purchased in Cash Principally for Income

(If your interest is only in growth, go to the next section, which has an example yielding 100% return.)

This is intended for a person who has considered bonds and is looking for income. This works well for someone with considerable cash (over $250,000), perhaps a person who gets a sizeable amount of money from a divorce, or from the sale of a residence, and can pay cash for the property -- why pay 5% - 6% interest to the bank (7% - 8% in 2022 - 2025) for a mortgage on an investment property?.

In a 2019 analysis I compared $1 Million invested in high-quality (i.e., investment-grade) corporate bonds against the cash purchase of five $200,000 2-bedroom/2-bath condominiums for rental in the Miami area. (If you've got less cash, you can use these results by adjusting them downwards; so if you have $400,000, you'll be buying two of these condominiums, and your income and appreciation will be 40% of the numbers shown here.)

An analysis can be done where you purchase duplexes, and the results are similar to those shown here. In Chapter 5, where we actually run some examples, we'll go through the numbers for BOTH a condo and a duplex.

I selected $200,000 condos because I found that in 2019 somewhere in the $200,000 to $350,000 range for condos and $400,000 - $550,000 range for duplexes is the sweet spot for good returns without excessive hassles; more on that here). In 2022+ the sweet spot is somewhere in the $300,000 to $450,000 range for condos and $550,000 to $700,000 for duplexes, because of the recent sharp increase in real estate values, but rents have increased even more, so the conclusions here are still valid.

The results of the comparison between the bonds and the 5 condominiums were that the 5 condos delivered a bit more monthly income than the bonds ($4,750 vs $4,600) after allowing for condominium expenses such as maintenance fees, property taxes and repairs, and for vacancies (details here). But there are two very important differences: the real estate delivers nearly 28% more after-tax income compared to bonds, and significant appreciation, with the real estate expected to grow to between $1.64 Million and $2.8 Million at 20 years, compared to bonds where the $1 Million didn't grow (details on both the after-tax advantages and appreciation, plus total returns are here).

Be sure to read the final section, with comments on other forms of real estate investments, some of the downsides of the investments described here and ways of mitigating them. Then go read Chapter 5, entitled Go Invest, where I take you by the hand and help you find the right properties to buy.

APPROACH 2. Real Estate Purchased With a Mortgage Principally for Growth

2022 CAVEAT: Please note the comments in red below, because with mortgage interest for investment properties at 7% - 8% and increased insurance rates, the investments described here will require careful analysis.

We'll first start with a variation of the apartment-for-rent investment covered in the previous section, but with a twist: you're financing part of the purchase rather than paying all cash. But at the end of this section I cover an aggressive (read: riskier) real-estate investment approach which can deliver nearly 100% returns, 10 times more than stocks.

The analysis that follows is intended for someone who is looking for growth rather than income, and is considering investing in an apartment to rent out. This could be in lieu of stocks, or even better, in addition to stocks, so you have a diversified growth portfolio that includes stocks and real estate.

In this case we'll be looking at financing part of the purchase with a mortgage. This works well for someone who has limited cash and also for an investor with cash who wants to use leverage to maximize returns (more on this later).

Here I looked at buying a $200,000 2-bedroom/2-bath condominium2 for rental in the Miami area with a $50,000 down payment and a $150,000 30-year mortgage of about 5.5% interest (7% - 8% in 2022+) -- this is higher than the prevailing rate because lenders typically require greater down payment and higher interest for investment property, compared to an owner-occupied property.

An analysis can be done where you purchase duplexes, and the results are similar to those shown here. In Chapter 5, where we actually run some examples, we'll go through the numbers for BOTH a condo and a duplex.

The resulting monthly income would be $950 after allowing for condominium expenses such as maintenance fees, property taxes and repairs, and for vacancies (details here) but before the mortgage payment and the insurance required by the lender. When the mortgage and insurance are considered, you have zero cash flow (i.e., rent income and all costs balance out); for the calculations and further details please go here.

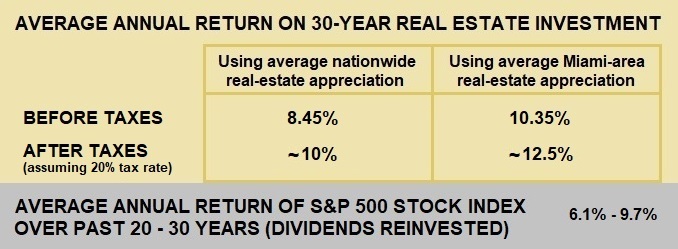

However, your gains over time are considerable because of the appreciation of the property, and it's forecast to deliver an annual return between 8.45% and 10.35% on your investment over the 30-year period of the mortgage. That's comparable or better than the S&P 500 stock market index, which has had an average annual return of 6.1% over the past 20 years, and 9.7% over the past 30 years (details here). This is partly because you're leveraging the lender's money, namely that your property -- all of your property, initially $200,000 but increasing with time -- is appreciating but you only invested $50,000.

An additional advantage of this real-estate investment, which has a bearing on your return, is that it's likely to reduce your taxes on other income. Typically, when you add the depreciation of the property (the reduction that is allowed for tax purposes in the value of an asset with the passage of time, even though the property is appreciating) to your related expenses (including mortgage interest), the investment shows in your annual income taxes as a large loss, thereby reducing the total income for the year -- in effect shielding some of the income from other sources, like your salary. So, considering this end-of-year tax savings, the above returns (8.45% - 10.35%) are comparable to a roughly 10% - 12% return from investments where the gains are taxable (income from corporate bonds are fully taxable, stock gains are taxable at a 20% rate if held over a year).

In short, for this example, the apartment-for-rent investment is comparable or superior to an investment in an S&P 500 stock market index mutual fund, and significantly superior on an after-tax basis, with less volatility. I have been too lazy to analyze the return at the 10 and 20 year points, before the mortgage is paid off, but I expect that the results will be similar. The returns presented above are in table format below. Although I stand by it, at least one person finds fault with my comparison of this real-estate investment with an S&P 500 stock investment (details here). Note again that this is with 5.5% mortgage interest; although rents have increased, it's not clear they would defray the higher mortgage interest of 7% - 8% in 2022+, and the results may be significantly worse.

It's important that you read the last section in this page with important information on other forms of real estate investments, some of the downsides of the investments described here and ways of mitigating them. Also, make sure you read Chapter 5, entitled Go Invest, where I take you by the hand and help you find the right properties to buy.

But what if you want a bigger return? Can you get close to 100% return?

This article shows how the leveraged appreciation of real estate can yield a theoretical return of 100%. And the approach is relatively simple and may be attractive for an aggressive investor unafraid of big debt. The following example, from the article, shows you how.

Two different buyers are planning on buying a $1 million residential property, and both have $1 million to spend. Person A buys all cash, while Person B puts 10% down and borrows the other 90%3. If the property goes up 10% in value, say in a year, it's now worth $1.1 million, meaning Person A has made a 10% return (they put in $1 million and now have $1.1 million) but Person B, who also made $100,000, has a 100% return, since he/she only put $100,000 down. But there's more. Person A can only afford to buy one $1 million property, but Person B can buy ten $1 million properties and control $10 million worth of property. If those properties all go up 10%, Person B makes $1 million on his/her $1 million investment -- again a 100% return. The key here is that the appreciation is all yours, none going to the lender, even though it put 90% of the funds.

This, of course, is a simplification. A more realistic view is a) that Person A (all cash) also has net rent income (after all costs) of, say $50,000 per year4, so the return is $150,000 (with the $100,000 appreciation) or 15% on the $1 million investment, and b) that the rent income for Person B (90% financing) won't cover the much larger expense of paying the $900,000 mortgage, so total return is expected to be less than 100%, my guesstimate is around 80% (68% if we assume 2022+ interest rate of 8%)5. Adding another bit of realism is that the 10% appreciation in just 1 year is untenable; historical real-estate annual appreciation is 3 - 6%, so if we assume 5%, then the annual realistic return is 7.5% for Person A (all cash) and 30% for Person B (18% if we assume 2022+ interest rate of 8%)6. For Person B that's still a huge return, so it's worth considering and running the numbers7, and you also have the tax advantage explained on the $200,000 condominium example above, where the depreciation losses of your real-estate investment can shelter profits from other sources.

Additional Must Read Information About Real Estate Investment

Obviously, this requires more work than picking up the phone and telling your investment broker to buy a mutual fund or bonds, but as you've seen it is very rewarding, with returns that can be superior to stocks or bonds, and without the volatility of stocks. You do need some guidance about real estate, including the areas were appreciation is likely to occur and the expected rent for a unit, but you can get such guidance from a Realtor and from the next Chapter, where I take you by the hand and help you find the right properties to buy. Also, there are techniques that minimize the hassles of being a landlord to the point where they can become insignificant; they are covered here.

To be fair, the real-estate examples presented above falls short of the so-called 1% Rule that some experts recommend; the rule and why I don't adhere to it are covered here.

One important point that was mentioned at the top of this page is worth repeating: that this type of real estate investment is considerably less liquid. Unlike stocks and bonds, if you need to cash out, it might take months to sell a property, so this is for money you know that you won't need for years. In that sense, it's the same as the advice I give on stocks, where you only invest with money you won't need for 5 - 10 years.

For Those Wanting A Simpler Approach With Less Money

For those who want a more liquid real-estate investment, those with less money to invest, or those wanting investments that require little effort, there are other ways of investing in real estate that are similar to investing in stocks or bonds, such as a mutual fund that invests in real estate or a Real Estate Investment Trust (REIT) which owns real estate. I have little experience with them, but a good article on REITs and other forms of investing in real estate may be found here.

There are now new ways to invest in properties YOU choose anywhere in the country that, again, require only hundreds of dollars and little effort by you. In the online service Roofstock you select from properties that have been ranked for location, condition, income and tenant history, and they take care of everything, including finding you a company that will manage the property for you. This article has more details on Roofstock and claims that it's as easy as buying stocks. Another company, Arrived, offers a similar service where you select from a curated selection of homes that have been vetted for their appreciation and rent income, and you invest with as little as $100; this article has more details on Arrived near the end (you may want to skip the earlier part where the writer is suggesting real estate because stocks are about to tank). Of course, fees for these services may reduce the financial returns but the yields may still be sizeable.

Please click on one of the buttons below to go to one of the other chapters on Investing. If you're considering buying real estate for investment, make sure you read the next Chapter, entitled Go Invest, where I take you by the hand and help you find the right properties to buy.

__________________________

1 I am NOT an investment professional -- I'm an aerospace engineer with a Master's from Caltech who drifted to the business side and spent the last half of my 30-year career dealing mostly with financial matters. After retiring I've spent the last 20+ years investing in stocks, bonds and real estate. Although this was first updated in October 2019, I've been reviewing it regularly and make changes/additions when warranted. The views expressed here are mine and at times may depart from the norm. In preparing this article I first read several articles, and ideas or phrases from those articles may have unintentionally crept into mine; I am happy to remove any plagiarism if alerted. 2 I chose a $200,000 condo because I've found that somewhere in the $200,000 to $350,000 range (in 2022+ $300,000 - $450,000) is the sweet spot for good returns without excessive hassles; more on that here).2 As indicated earlier, I chose a $200,000 condo because I've found that somewhere in the $200,000 to $350,000 range (in 2022+ $300,000 - $450,000) is the sweet spot for good returns without excessive hassles; more on that here).

3 90% financing on an investment property is hard to obtain, but this example is from the article, and 90% financing may be available to a person with excellent credit and a huge net worth.

4 This is extrapolated from the all-cash investment of a $200,000 apartment example covered in the prior section.

5 I say "guesstimate" because it was a quick calculation done with the higher mortgage loan and with an interest rate of 7% instead of 5.5% used in the prior example (because of the higher loan-to-value ratio of 90%). So, in this case, rent income did not cover expenses, with a shortfall of $20,000 per year -- the yearly appreciation of $100,000 is thus reduced by the $20,000, for a return of $80,000 on the investment of $100,000. I actually expect it to be somewhat lower because once you move up in value to properties in the $1M range, away from the sweet-spot of cheaper units mentioned earlier, you generally find that other expenses are disproportionately higher. Note that at an interest rate of 8% in 2022+ the annual shortfall is $32,000, for a return of $68,000 on the investment of $100,000.

6 The annual $50,000 appreciation minus the $20,000 you have to pay yearly because rent income doesn't cover expenses yields a $30,000 gain on your $100,000 investment (and only an $18,000 gain on your $100,000 investment if we assume an interest rate of 8% after 2022). Note that if the annual appreciation is only 3%, the lowest end of the historical range, there is still a 10% return ($30,000 appreciation minus the $20,000 shortfall) with a 7% mortgage, but near-zero return with an 8% mortgage after 2022 which has a $32,000 annual shortfall.

7 As the above footnotes show, if the interest rate after 2022 is 8% or higher and the annual appreciation is under the assumed 5%, the return may be close to zero, and this may not be worth it when you consider the extra work of managing real estate and the lack of liquidity.